The Complete Guide to Scope 3 Emissions: the 15 Categories Explained and Illustrated

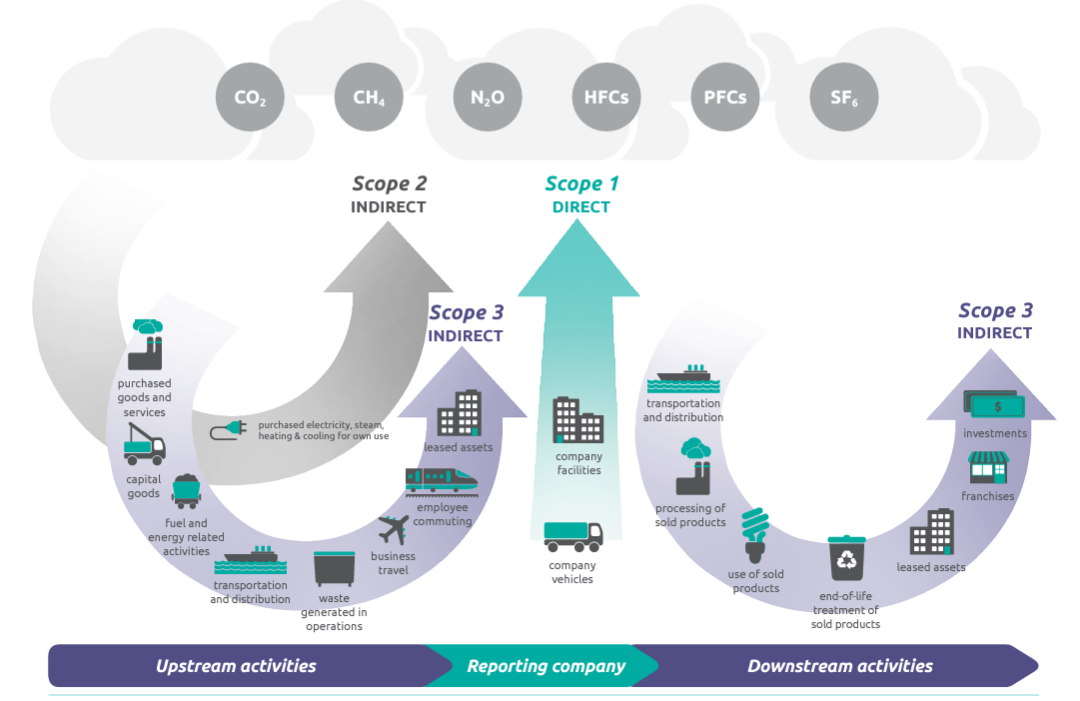

Did you know that for most companies, indirect emissions can account for over 70% of their total carbon footprint? While many organizations have mastered tracking their Scope 2 emissions from purchased energy, the true challenge lies in understanding the complex web of indirect emissions across their entire value chain. As ESG data requirements become increasingly stringent, companies face mounting pressure to look beyond their direct operations and energy consumption.

Scope 3 emissions represent the final piece of the carbon puzzle, encompassing everything from supplier activities to product end-of-life. Yet, according to our latest study, less than 30% of companies effectively measure these emissions—creating a significant blind spot in corporate sustainability efforts.

In this guide, we’ll explore all 15 Scope 3 categories as defined by the Greenhouse Gas (GHG) Protocol, highlight real-world examples from companies at the forefront of Scope 3 data management, and understand the various industry applications of Scope 3 emissions data. By the end, you’ll understand why addressing Scope 3 emissions is essential for any organization aiming to meet ambitious climate goals.

The 15 Scope 3 Categories: A Complete Overview

The Greenhouse Gas Protocol has established 15 distinct categories of Scope 3 emissions, providing a comprehensive framework for organizations to assess their indirect emissions across both upstream and downstream activities in their value chain. In the following sections, we'll explore each category in detail, examining how industry leaders are measuring, managing, and reducing these emissions through real-world initiatives and practical strategies.

Category 1: Purchased Goods and Services

Emissions from the production of goods and services that a company acquires. This is particularly relevant in sectors with complex supply chains, such as technology and retail.

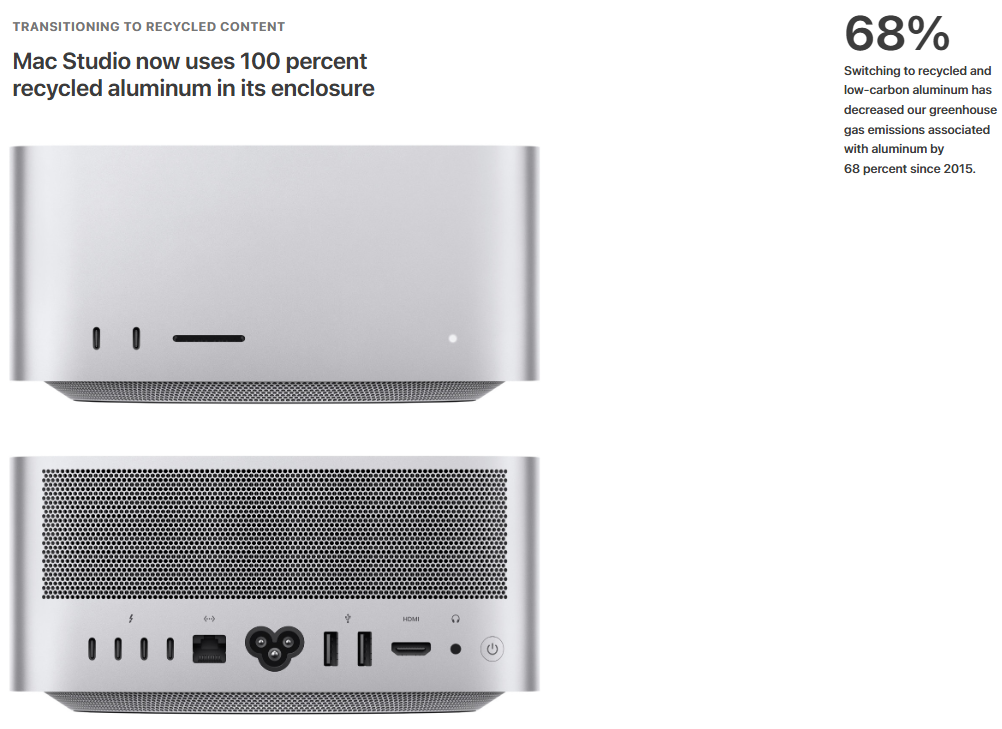

Apple, for example, relies heavily on aluminum for its device casings, including MacBooks, iPads, and iPhones. Producing aluminum involves energy-intensive processes—such as bauxite mining, alumina refining, and aluminum smelting—that result in significant emissions. For Apple, these emissions fall under Scope 3 (purchased goods and services) as they stem from indirect, upstream activities tied to its aluminum demand.

Category 2: Capital Goods

Emissions associated with the production of long-term assets, such as machinery, buildings, and vehicles. These assets are essential for a company’s operations but often require energy-intensive manufacturing processes that contribute to Scope 3 emissions. This category is particularly relevant for industries with significant infrastructure and equipment needs, such as technology, manufacturing, energy, construction, and transportation.

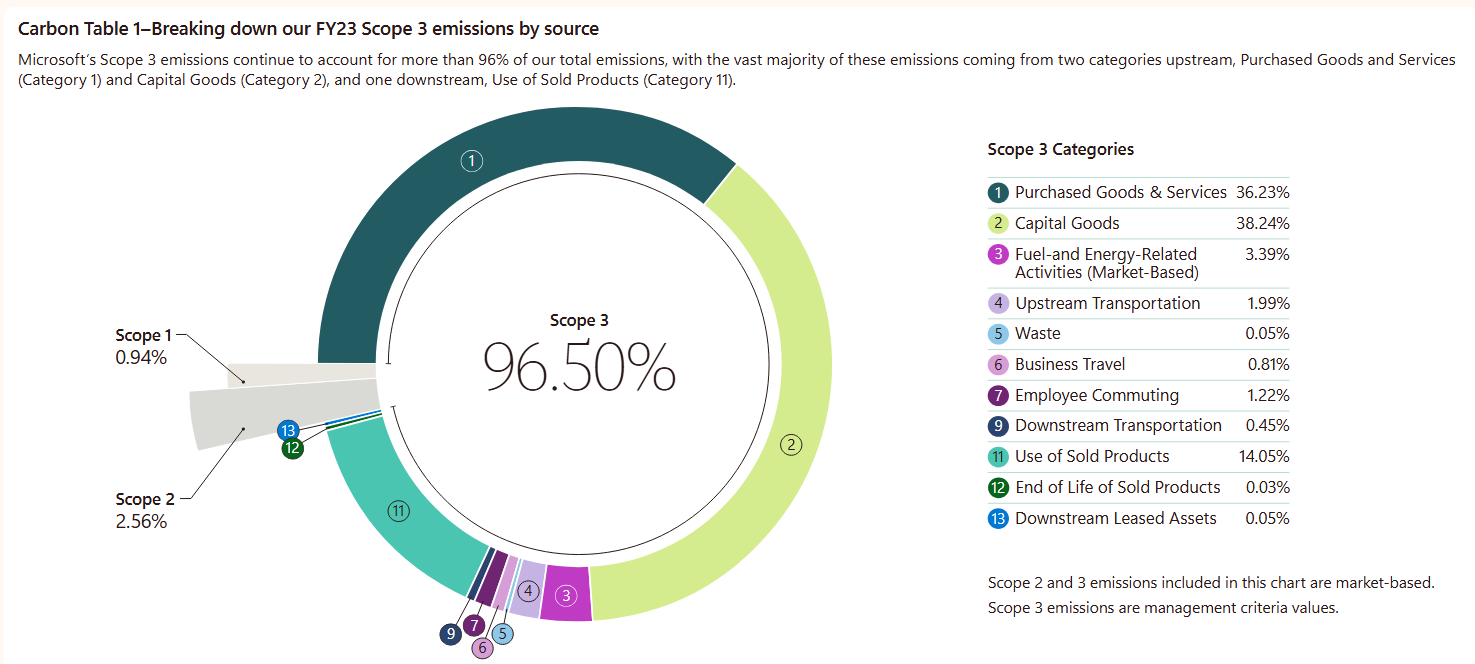

For example, Microsoft invests in capital goods like data center infrastructure and office buildings. The production of these assets generates significant emissions from material extraction, construction, and manufacturing processes. These emissions are categorized as Scope 3 (capital goods) because they stem from upstream activities required to build and maintain the infrastructure that powers Microsoft’s operations.

Category 3: Fuel- and Energy-Related Activities (Not Included in Scope 1 or Scope 2)

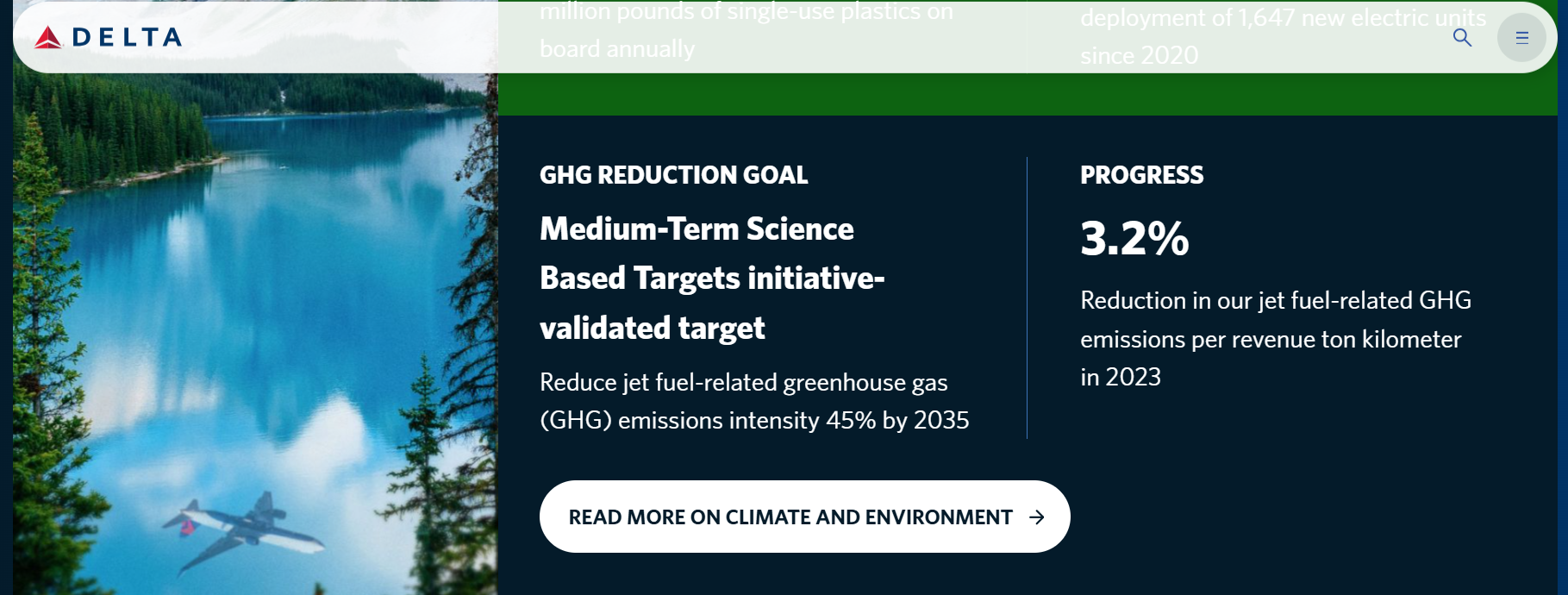

Emissions from the production, transportation, and distribution of fuels and energy purchased or consumed by a company, excluding those already accounted for in Scope 1 or 2. These upstream emissions are particularly significant for industries with high energy or fuel dependency, such as aviation.

For example, Delta Air Lines generates substantial Scope 3 emissions from fuel- and energy-related activities, such as the extraction, refining, and transportation of jet fuel. While the combustion of jet fuel is accounted for in Delta’s Scope 1 emissions, the emissions associated with the supply chain of that fuel—including upstream production and processing—are categorized under Scope 3.

Category 4: Upstream Transportation and Distribution

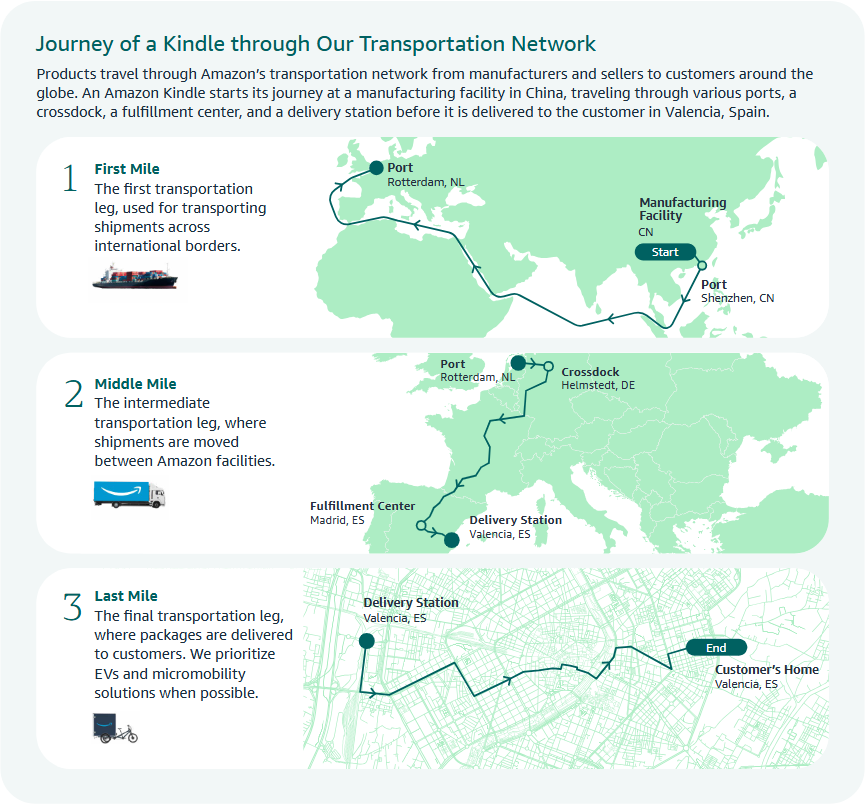

Emissions from the transportation and distribution of goods purchased by a company in vehicles and facilities not owned or controlled by the company, as well as emissions from third-party inbound logistics. These emissions are especially significant for industries reliant on extensive supply chain networks, such as retail, consumer goods, and e-commerce.

For example, Amazon generates notable Scope 3 emissions from upstream transportation and distribution activities, including emissions from the shipping and handling of products by third-party carriers. While Amazon’s own fleet operations are included in Scope 1 emissions, the emissions from external logistics partners, such as delivery trucks, freight transportation, and warehousing, fall under Scope 3.

Category 5: Waste Generated in Operations

Emissions from the disposal and treatment of waste generated in a company’s operations, occurring in facilities not owned or controlled by the company. These emissions stem from processes such as landfilling, incineration, recycling, and composting.

This category is particularly relevant for the manufacturing sector due to its high operational waste output. For example, BASF SE, a global leader in chemical manufacturing, reported 1.05 million metric tonnes of carbon dioxide equivalent emissions in 2023 related to Scope 3 waste—one of the highest in the industry.

These emissions arise from the treatment of waste generated during chemical manufacturing processes, including process residues, byproducts, and wastewater sludge. While BASF has implemented advanced on-site measures to reduce and recycle waste, emissions from third-party facilities, such as the incineration of hazardous waste and energy-intensive recycling operations, are included under Scope 3.

Category 6: Business Travel

Emissions from employee travel for business purposes in third-party vehicles, including aircraft, trains, cars, and other modes not owned or controlled by the company.

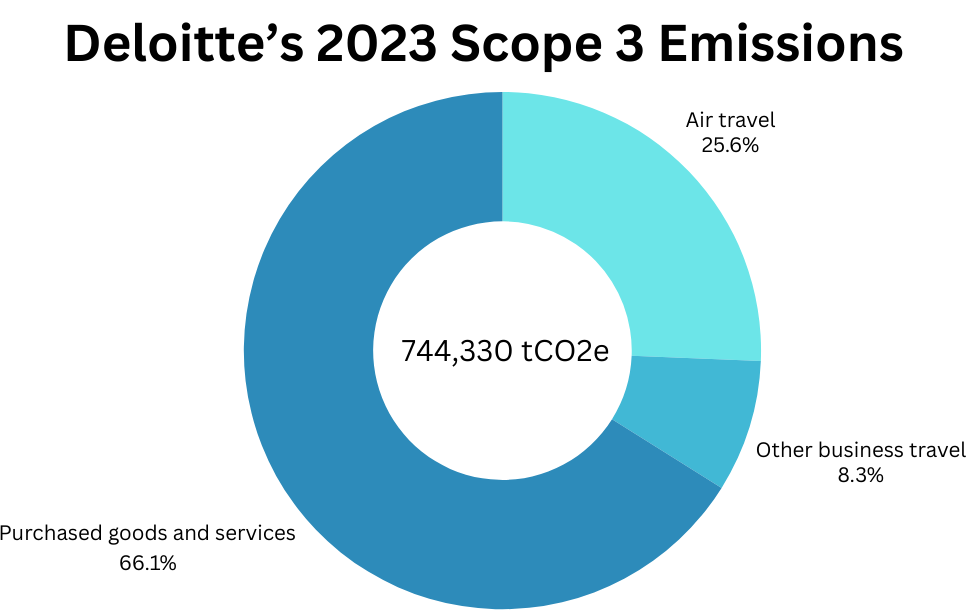

Business travel emissions are particularly significant for sectors with frequent travel needs, such as consulting, technology, and finance, which often operate as multinational corporations with a global workforce.

To manage these emissions, Deloitte is working to reduce its air travel footprint by exploring low-carbon travel options and collaborating with airlines using sustainable aviation fuel (SAF).

Category 7: Employee Commuting

Emissions from employee commuting, including travel to and from the workplace in third-party vehicles such as personal cars, public transportation, carpooling, and bicycles.

These emissions are particularly relevant for sectors with large workforces or centralized office spaces where commuting is a significant activity. For example, with over 1.5 million employees across fulfillment centers, corporate offices, and delivery hubs, Amazon reported that 5.6% of its Scope 3 emissions came from employee commuting in 2023.

To measure these emissions, Amazon identified how employees commute—whether walking, carpooling, driving, or using public transportation—and calculated emissions based on travel distances, transportation modes, and tailpipe emissions factors from national and regional data. Combined with commute frequency, this approach enables Amazon to accurately estimate the carbon footprint of its workforce's commuting activities.

Category 8: Upstream Leased Assets

Emissions from assets leased by a company that are not included in its Scope 1 or Scope 2 emissions. These assets, such as data centers, office spaces, warehouses, and equipment, are owned by third parties and operated on the company’s behalf, making their emissions part of the company’s Scope 3 inventory.

This category is particularly relevant for industries that rely heavily on leased facilities, such as technology, finance, and logistics.

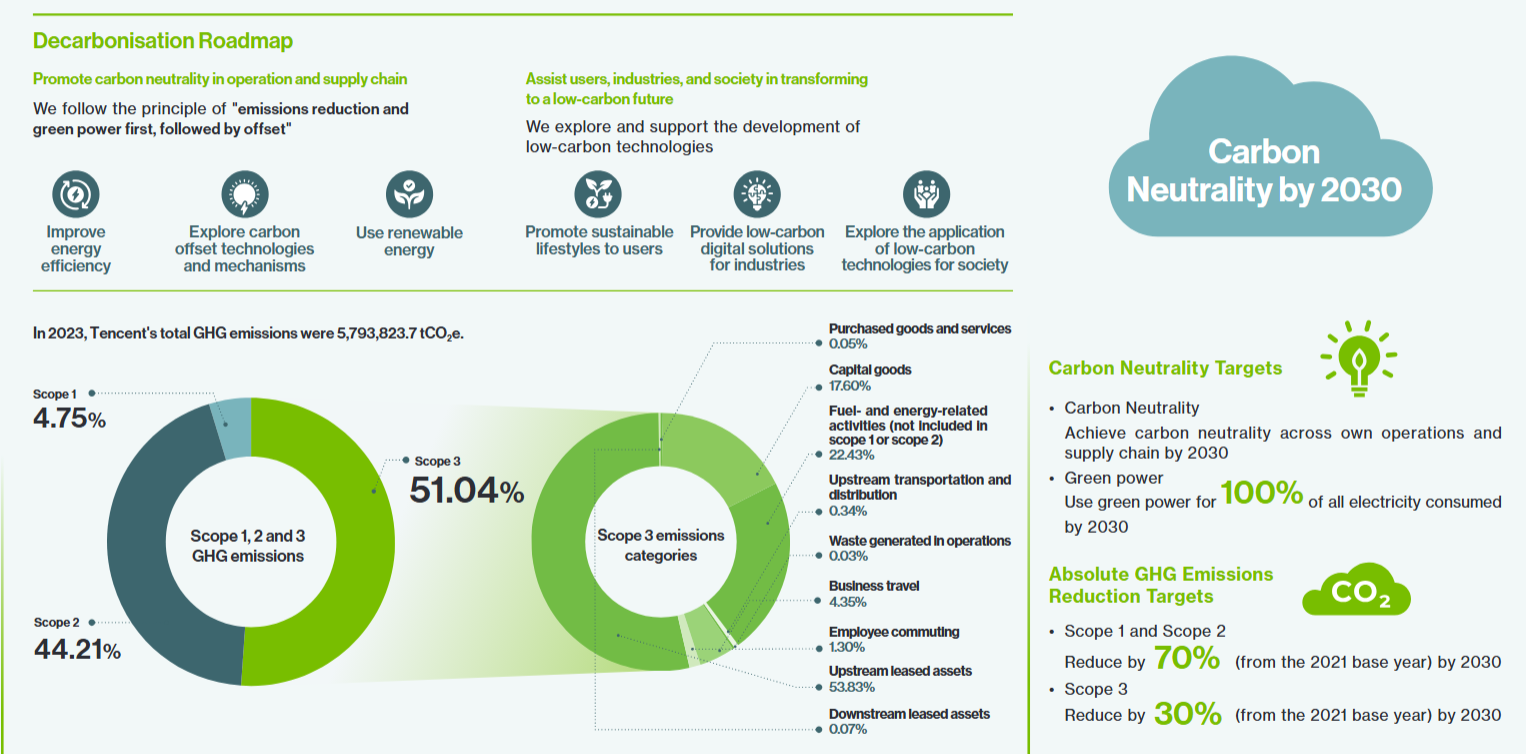

While emissions from Tencent-owned facilities are categorized under Scope 1 and Scope 2, emissions from heating, cooling, and electricity in leased properties fall under Scope 3. To address these emissions, Tencent collaborates with third-party landlords to improve energy efficiency, incorporate renewable energy, and transition to green-certified buildings. These measures support Tencent’s strategy to achieve carbon neutrality across its operations and supply chain by 2030.

Category 9: Downstream Transportation and Distribution

Emissions from the transportation and distribution of a company’s sold products to end customers, occurring in vehicles and facilities not owned or controlled by the company. These emissions arise from third-party logistics providers, including trucks, ships, trains, and airplanes, as well as warehouses and retail distribution centers.

This category is particularly relevant for industries with extensive product distribution networks, such as retail, consumer goods, and logistics.

For example, around 10% of the total Scope 3 emissions in 2023 for Target Corporation, a major U.S. retailer, came from downstream transportation and distribution. These emissions are included in Target’s 2030 absolute Scope 3 emissions reduction goal, alongside purchased goods and services, upstream transportation, and the use of sold products. To address these emissions, Target is reducing its reliance on trucks by shifting to rail and barge transportation, testing alternative fuels with logistic carriers, increasing cargo efficiency, and improving the accuracy of product deliveries.

Category 10: Processing of Sold Products

Emissions from the processing of intermediate products sold by a company that are later processed by third parties before being sold to end customers. These emissions occur during manufacturing or transformation activities and are particularly relevant for industries that produce raw materials or components, such as mining, metals, and chemicals.

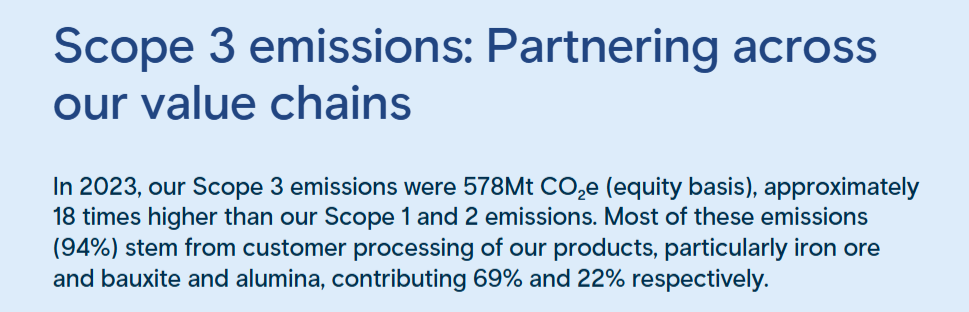

This category is significant for companies whose products undergo additional energy-intensive processing downstream in the value chain.

These materials are further processed by third parties into steel and aluminum, essential for industries like construction, automotive manufacturing, and aerospace. Emissions arise from energy-intensive activities such as smelting, refining, and casting.

To address these emissions, Rio Tinto is collaborating with customers to improve energy efficiency in refining and transport, as well as advancing technologies for carbon-free aluminum smelting. These initiatives reflect Rio Tinto’s broader commitment to decarbonize its value chain and achieve net-zero emissions by 2050.

Category 11: Use of Sold Products

Emissions generated during the use phase of products sold by a company, occurring after the product is delivered to the customer. These emissions arise from the energy consumption, fuel use, or other processes required for the product to function as intended. This category is particularly significant for industries producing energy-consuming goods, such as automotive, electronics, and appliances.

For example, Ford Motor Company, a global automotive manufacturer, generates significant Scope 3 emissions from the use of its sold vehicles, which rely on gasoline or diesel engines. These emissions account for 87% of Ford’s Scope 3 inventory, as vehicles emit greenhouse gases throughout their operational lifetimes.

By expanding its EV lineup, improving vehicle energy efficiency, and reducing reliance on fossil fuels, Ford aims to significantly lower emissions during the use phase and achieve carbon neutrality by 2050.

Category 12: End-of-Life Treatment of Sold Products

Emissions generated from the disposal and treatment of products sold by a company at the end of their useful life. These emissions arise from activities such as landfilling, incineration, recycling, and composting. This category is particularly relevant for industries producing goods with short lifespans or significant waste streams, such as consumer goods, packaging, electronics, and automotive.

To address these emissions, Unilever is reducing packaging use, increasing the use of post-consumer recycled materials, and designing packaging for recyclability. The company also advocates for improved waste collection systems and scales up refill and reuse models. These efforts align with Unilever’s goal to achieve net-zero emissions across its value chain by 2039 and ensure 100% of its plastic packaging is reusable, recyclable, or compostable by 2025.

Category 13: Downstream Leased Assets

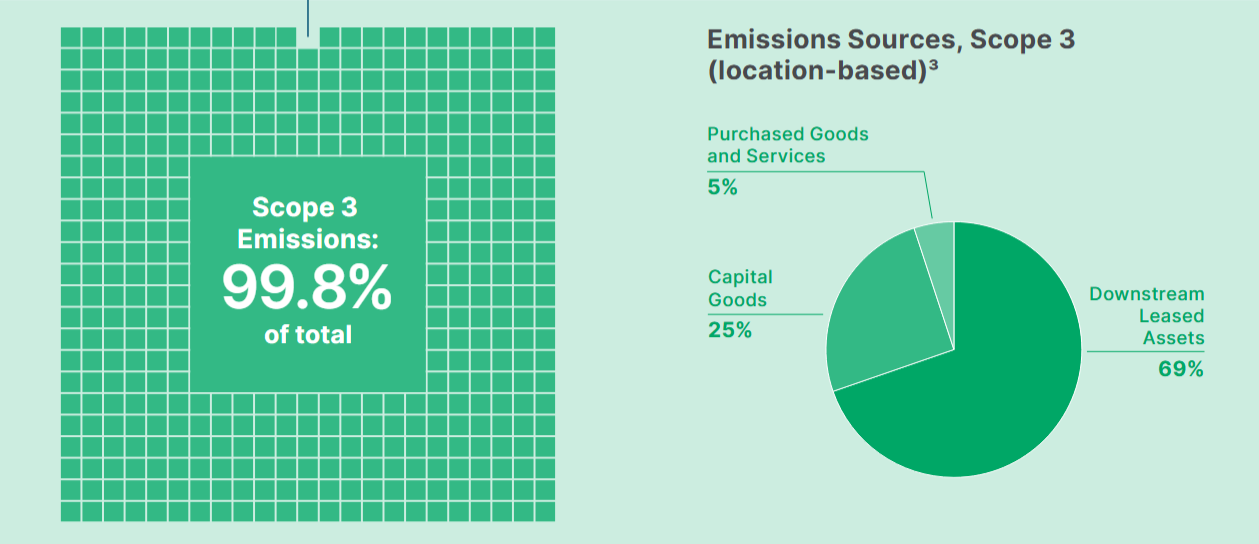

Emissions generated from the operation of assets owned by a company and leased to third parties. These emissions occur in facilities and vehicles leased out, where energy consumption and operational activities are not under the company’s direct control. This category is particularly relevant for industries leasing commercial spaces, equipment, or vehicles, such as real estate, logistics, and transportation.

To address these emissions, Prologis is upgrading leased facilities with energy-efficient systems, including advanced lighting, heating, and cooling solutions, and promoting renewable energy through solar panel installations on warehouse rooftops. The company also collaborates with tenants to improve energy management practices and reduce operational emissions.

These initiatives align with Prologis’ commitment to achieving net-zero emissions across its value chain by 2040 and supporting its tenants in reducing their environmental impact.

Category 14: Franchises

Emissions generated from the operation of franchises not owned by a company but operating under its brand name. These emissions occur in franchise facilities and operations, where the energy use, transportation, and other activities contribute to the company’s Scope 3 inventory. This category is particularly relevant for industries such as retail, hospitality, and food services, which often rely on franchised business models.

To address these emissions, McDonald’s has set a target to reduce absolute Scope 3 emissions from energy and industrial activities by 50.4% by 2030, covering franchised and company-owned restaurants, as well as facility, logistics, and plastic packaging emissions across its supply chain, aligning with its broader ambition to achieve net-zero emissions by 2050.

Category 15: Investments

Emissions generated from a company’s investments, including equity, debt, or other financial instruments, where it has partial ownership or influence over external operations. These financed emissions are accounted as Scope 3 for the reporting company and include the direct (Scope 1) and indirect (Scope 2 and 3) emissions of the investee companies. This category is particularly relevant for industries such as financial services, asset management, insurance, and private equity.

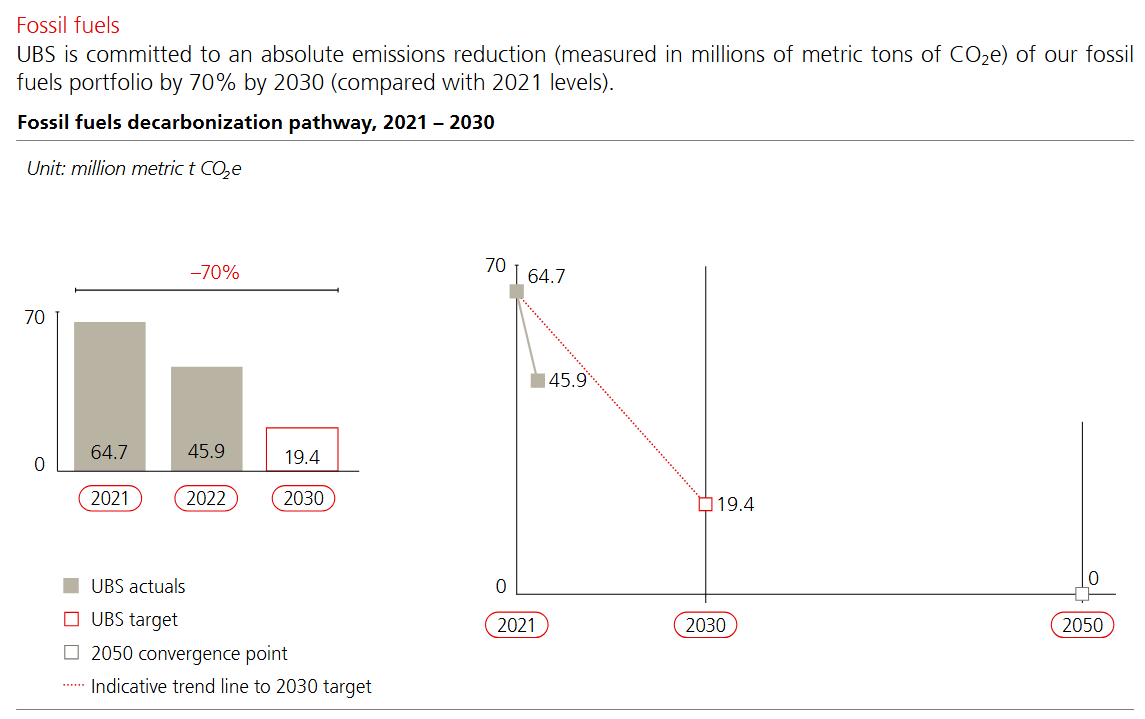

For example, UBS, a global financial services firm, generates significant Scope 3 emissions through its financed activities, including investments and loans across sectors such as energy and real estate. These emissions result from the greenhouse gas outputs of the companies and projects UBS supports through its investment and lending portfolios.

Industry Applications: Leveraging Scope 3 Data for Sustainability

Scope 3 data enables companies to make informed decisions that support sustainability goals, meet regulatory requirements, and respond to customer demands for environmentally responsible products.

1. Asset Management

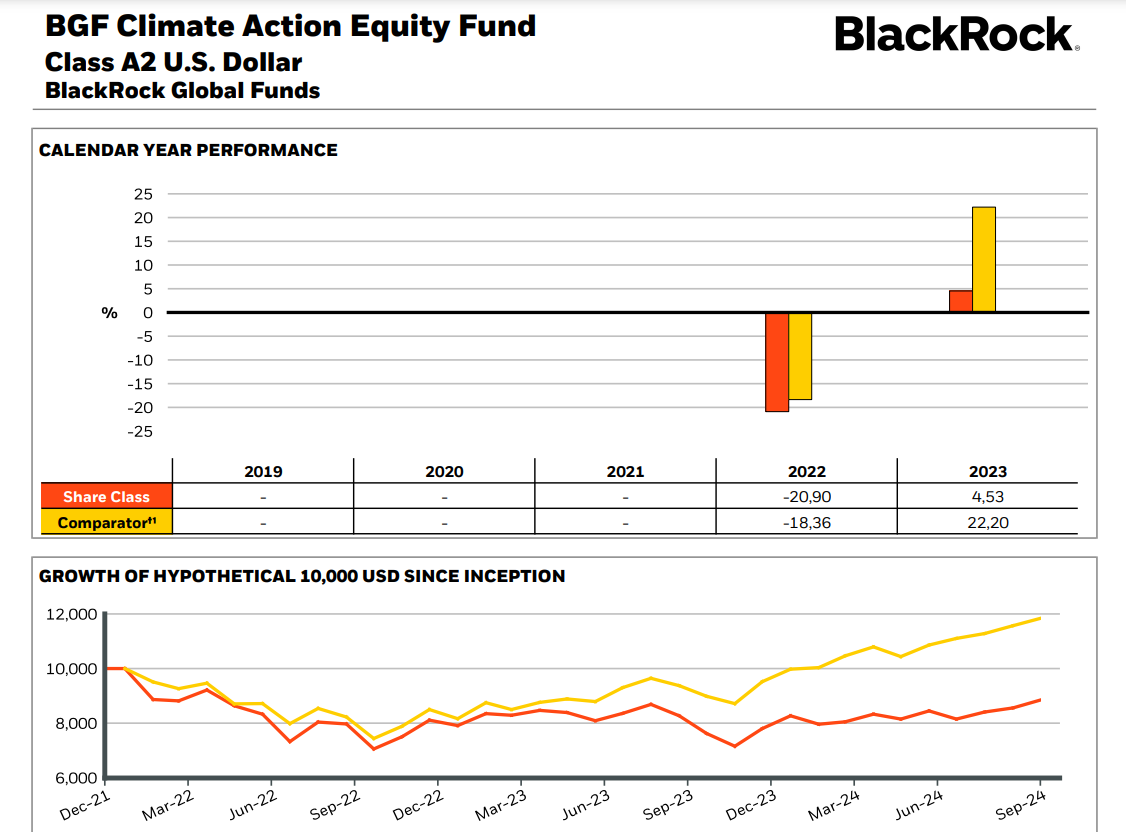

Asset managers integrate Scope 3 data into investment strategies to assess portfolio companies' climate impacts and guide sustainable investments.

2. Corporates

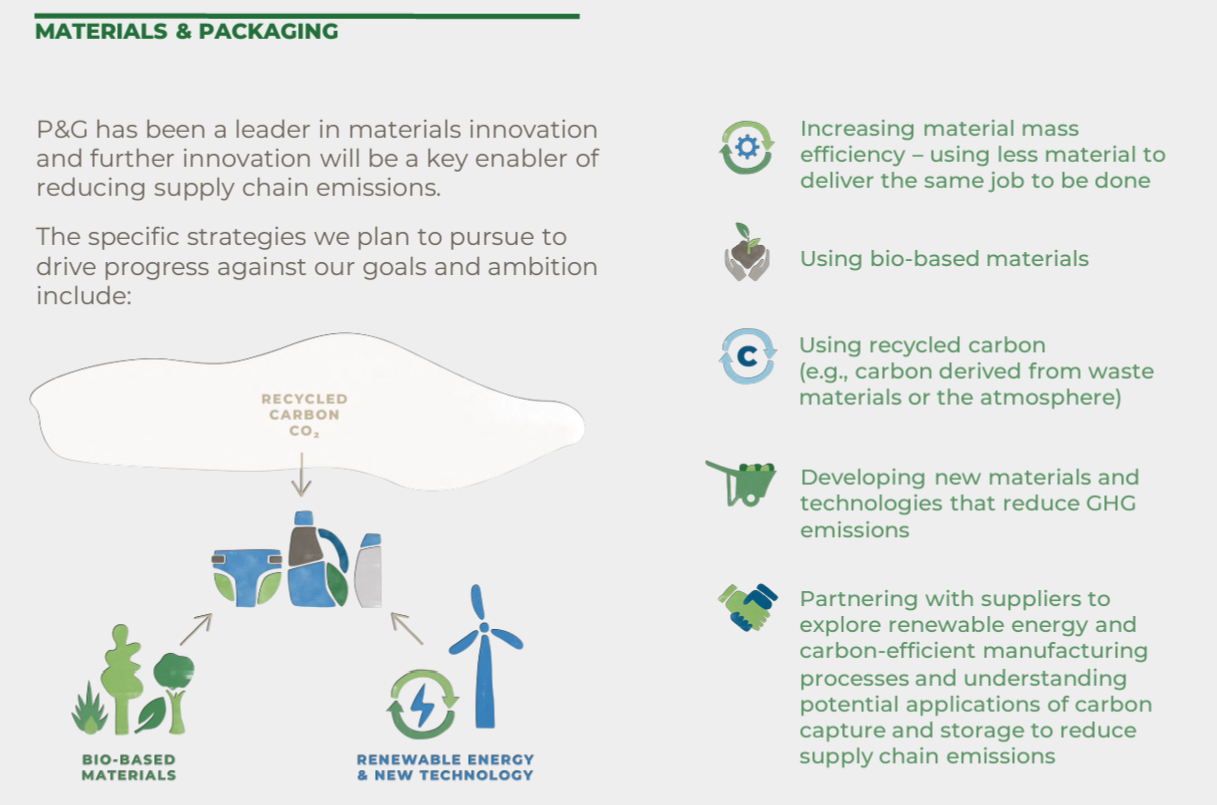

Corporations in consumer goods, technology, and manufacturing sectors leverage Scope 3 data to minimize environmental impact and drive supply chain sustainability.

3. Banking

Banks use Scope 3 data to measure and manage financed emissions associated with lending and investment portfolios.

4. FinTech and Climate Tech

FinTech and Climate Tech firms provide tools and platforms to help companies quantify and manage Scope 3 emissions, enabling data-driven decisions that align with ESG goals.

Turning Scope 3 Data into Action

Managing Scope 3 emissions represents both a significant challenge and an unprecedented opportunity for organizations across the global economy. While these indirect emissions often constitute the largest portion of an organization's carbon footprint, they also offer the greatest potential for driving meaningful environmental impact through innovative solutions and collaborative approaches.

Whether you're an asset manager integrating climate considerations into investment decisions, a financial institution aligning lending portfolios with sustainability goals, or a corporate leader transforming your supply chain, success in addressing Scope 3 emissions begins with access to comprehensive, reliable data.

Ready to unlock the power of emissions data?

Explore Tracenable’s GHG Emissions Data Factsheet covering over 5,000 companies for detailed insights into the scope, depth, and applications of our data. Download a free sample data and turn information into action toward a more sustainable future.