Scope 1, 2, and 3 Emissions Explained: From Theory to Practical Data Applications

Tackling climate change starts with understanding where emissions come from. But with emissions originating from so many sources, how do companies begin to track, manage, and reduce their environmental impact? This is where Scope 1, 2, and 3 emissions come into play.

These categories provide a framework within ESG data for understanding where emissions come from and how they contribute to a company’s overall carbon footprint. In this post, we’ll break down each scope, explain how emissions are calculated, and explore practical applications for using emissions data in industries such as asset management, banking, GreenTech, and FinTech.

Ready to learn how emissions data can guide better decisions and drive meaningful change? Let’s dive in.

The Fundamentals: Understanding Scope 1, 2, and 3 Emissions

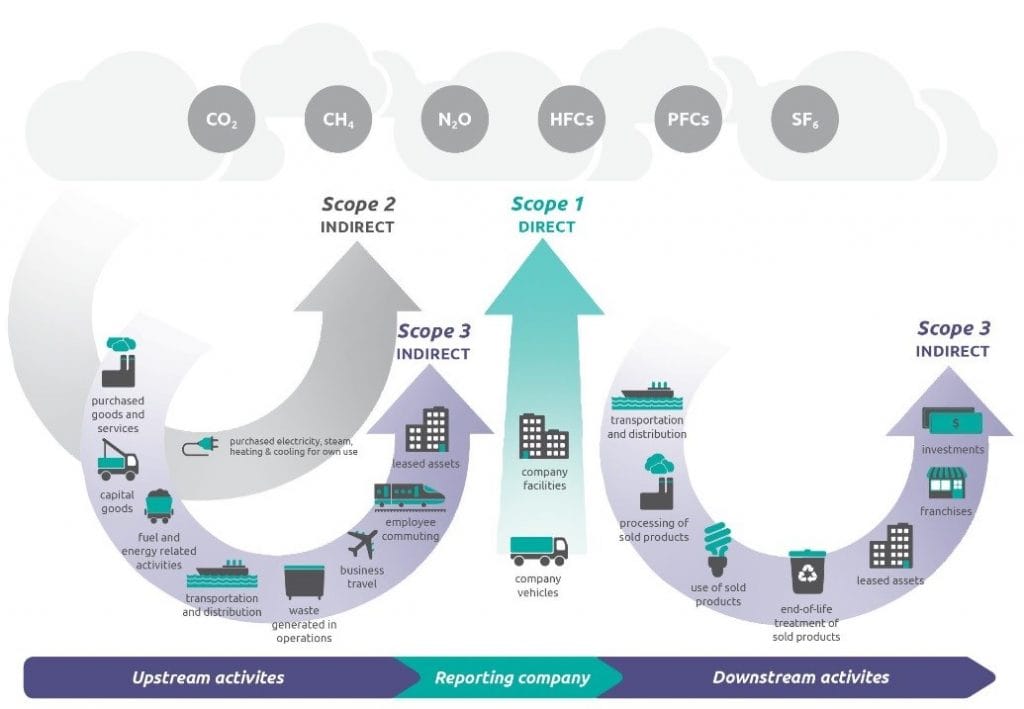

To fully understand a company’s emissions footprint, we need to distinguish between the three scopes as defined by the Greenhouse Gas Protocol. Each scope covers a different source of emissions, from direct emissions to those generated throughout the value chain.

Scope 1: Direct Emissions

Scope 1 includes all direct GHG emissions from sources owned or controlled by a company. These emissions arise from activities like fuel combustion in company-owned facilities, vehicles, and machinery. If a company is burning fuel on-site or using equipment that releases GHGs, these emissions fall under Scope 1.

Example: Mr. Phillip’s bike factory operates a fleet of delivery trucks and uses natural gas to power its manufacturing equipment. Both the fuel burned in the trucks and the gas used on-site are classified as Scope 1 emissions because the factory directly controls these activities.

Scope 2: Indirect Emissions from Purchased Energy

Scope 2 encompasses indirect emissions generated by the production of energy that a company purchases and consumes. This includes electricity, heating, and cooling produced outside the company but used within its operations. While the company doesn’t directly emit these gases, its demand for energy leads to emissions.

Example: Mr. Phillip’s bike factory relies on electricity from the local power grid to run its production lines. Although the factory doesn’t generate these emissions directly, they are counted as Scope 2 because they result from the factory’s energy consumption.

Scope 3: Indirect Emissions from the Value Chain

Scope 3 emissions are the most complex to measure. They include all indirect emissions across the entire value chain—both upstream and downstream. This includes emissions from the production of raw materials, supplier activities, business travel, and even the disposal of a company’s products. Scope 3 typically makes up the largest share of a company’s carbon footprint, encompassing activities that are beyond direct control but influenced by the company’s operations.

Example: Mr. Phillip’s bike factory sources aluminum from a supplier that produces significant emissions during mining and smelting. Additionally, once the bikes are shipped to retailers and consumers, transportation emissions also fall under Scope 3. Even emissions generated when consumers use and dispose of the bikes count toward the company’s Scope 3 total.

How Scope 1, 2, and 3 Emissions Are Calculated

Calculating emissions across all scopes requires robust methodologies. The Greenhouse Gas Protocol is the most widely used framework, providing specific guidance for measuring emissions from direct activities (Scope 1), purchased energy (Scope 2), and value chain activities (Scope 3). Each scope requires different data sources, such as fuel consumption records for Scope 1, electricity bills for Scope 2, and supplier emissions disclosures or lifecycle assessments for Scope 3.

By applying standard conversion factors and emissions coefficients, companies can estimate their total GHG emissions across all three scopes, giving them a comprehensive view of their environmental impact.

The Importance of Accurately Tracking GHG Emissions

For many sectors, precise emissions tracking is essential, empowering them to make data-driven decisions that enhance sustainability and regulatory compliance.

For companies, GHG data is foundational for achieving net-zero targets, meeting internal sustainability goals, and driving innovation in low-carbon products. This data also supports transparency in sustainability reporting, allowing companies to benchmark against industry standards and manage carbon risks effectively.

Asset managers and financial institutions leverage GHG data differently. Asset managers use it to comply with frameworks like the Sustainable Finance Disclosure Regulation (SFDR) and the Task Force on Climate-related Financial Disclosures (TCFD), ensuring portfolios align with net-zero goals and support emissions-based screening in investment strategies. Financial institutions rely on GHG data to develop green finance products, perform carbon risk assessments, and guide clients toward environmentally responsible lending and investment.

FinTech and GreenTech companies are also using emissions data to pioneer impactful solutions. FinTech firms develop regulatory compliance platforms, create proprietary ESG metrics, enable value-aligned investing through intuitive dashboards, and support sustainable payment solutions. Meanwhile, GreenTech companies use emissions data to benchmark product sustainability, conduct lifecycle analyses, and enhance supply chain transparency.

In the next section, we’ll explore four case studies illustrating how asset management, banking, FinTech, and GreenTech sectors use emissions data to drive meaningful impact.

Case Studies: Industry Applications of Emissions Data

1. Asset Management

Asset managers increasingly align their portfolios with SFDR and TCFD requirements, integrating Scope 1, 2, and 3 data into their investment decisions. By understanding the emissions profile of portfolio companies, they can steer investments toward businesses with lower environmental risks and greater sustainability potential.

For example, Invesco offers the Global Clean Energy UCITS ETF (GCLE), classified as an Article 9 SFDR fund. Invesco has incorporated Scope 1, 2, and 3 emissions data into its decision-making process when selecting companies for the fund, ensuring alignment with sustainability goals and regulatory standards.

2. Financial Institutions

Banks use emissions data to develop green finance products, such as loans and bonds tied to sustainability performance. Accurate Scope 3 data enables these institutions to evaluate the full carbon impact of their clients, supporting environmentally responsible lending and investment practices.

For example, HSBC launched its Green Financing Framework, which ties loan terms to a client’s sustainability performance. HSBC uses Scope 1, 2, and 3 emissions data to assess the environmental impact of companies across their entire value chain. Companies that show significant potential for avoiding GHG emissions are eligible for preferential loan terms, such as lower interest rates. By linking financial incentives to carbon reduction, HSBC ensures its green finance products align with global sustainability goals.

3. FinTech

FinTech startups leverage emissions data to create tools that allow consumers and investors to align their financial choices with climate goals. From carbon offsetting platforms to emissions-based investment screening tools, FinTech is driving innovation in the ESG space by harnessing raw, traceable data.

For example, Aspiration, a FinTech startup, offers climate-friendly banking and investment products. Aspiration uses Scope 1, 2, and 3 emissions data to allow users to track and offset their carbon footprint, helping them align their financial activities with environmental goals.

4. GreenTech & ClimateTech

Companies in the green technology sector integrate emissions data into product lifecycle assessments and sustainable supply chain management. By optimizing the entire production process based on emissions data, GreenTech companies can deliver products that reduce environmental impact while meeting the demands of eco-conscious consumers.

For example, Emitwise is a carbon accounting platform that helps companies track and benchmark their emissions across Scope 1, 2, and 3. Its benchmarking feature enables companies to compare their carbon footprint with industry peers, helping them identify areas for improvement and set competitive decarbonization goals. By comparing emissions performance against competitors, companies can position themselves for sustainability certifications or attract investment as leaders in carbon reduction.

Turning Data into Action

As the world shifts toward a more sustainable future, understanding and managing GHG emissions is key to driving meaningful change. Scope 1, 2, and 3 data provide the roadmap for identifying where emissions come from and how to reduce them effectively. By leveraging this data, businesses and investors can align their strategies with global environmental goals, reduce their carbon footprints, and make a lasting impact. Furthermore, innovative GreenTech and FinTech companies can use this data to create groundbreaking, impact-driven solutions that drive real progress toward a more sustainable future.

Explore Our GHG Emissions Data

At Tracenable, we have been collecting Scope 1, 2, and 3 emissions historical data on over 5,000 companies. Willing to learn more? Review our GHG Emissions Data Product Factsheet to learn more about the depth and quality of our data. Discover how this dataset can support your decarbonization strategy, help you build innovative solutions, and drive positive change. Access a sample of our data and turn information into action toward a more sustainable future.