How Can Investors Use the EU Taxonomy for Sustainable Investing?

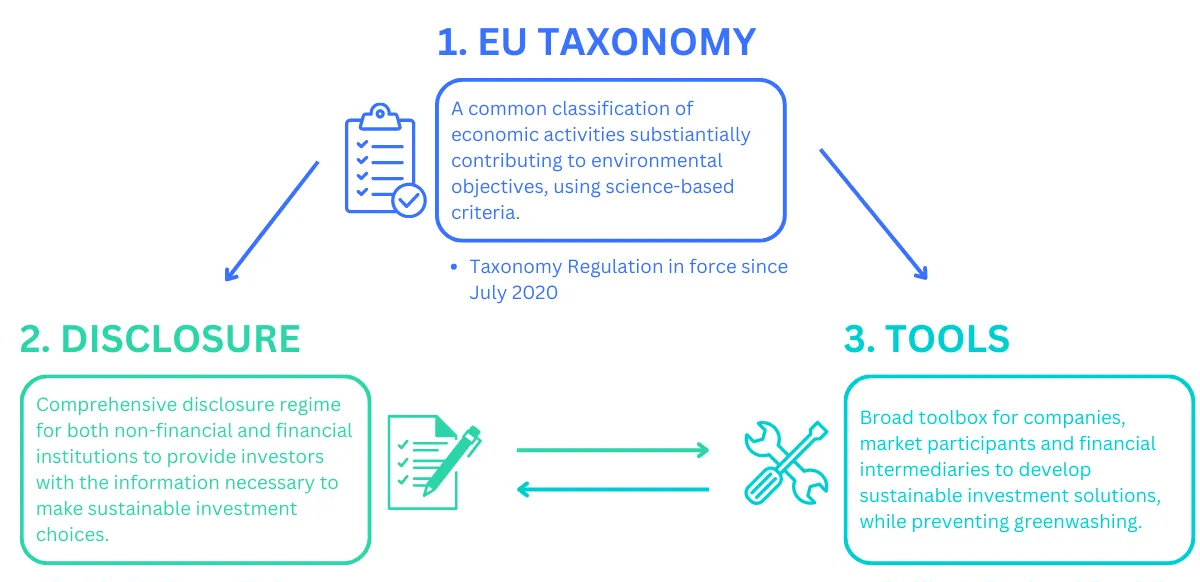

Sustainable investing—once a niche area—has become a major force shaping global finance, with many investors seeking not only financial returns but also positive environmental and social impacts. Within Europe, a key driver of this trend has been the European Union’s Taxonomy for Sustainable Activities (often called the EU Taxonomy).

The EU Taxonomy provides a standardized classification system that defines what counts as “environmentally sustainable,” aiming to direct capital toward truly green activities and reduce greenwashing. For investors, it can serve as both a regulatory requirement and a practical tool to guide portfolio decisions. This blog post explains how.

What is the EU Taxonomy?

The Taxonomy emerged in the wake of the EU’s 2018 Action Plan on Financing Sustainable Growth [1]. Building on that momentum, the Taxonomy Regulation (Regulation (EU) 2020/852) [2] introduced detailed, science-based criteria for determining whether an economic activity is sustainable.

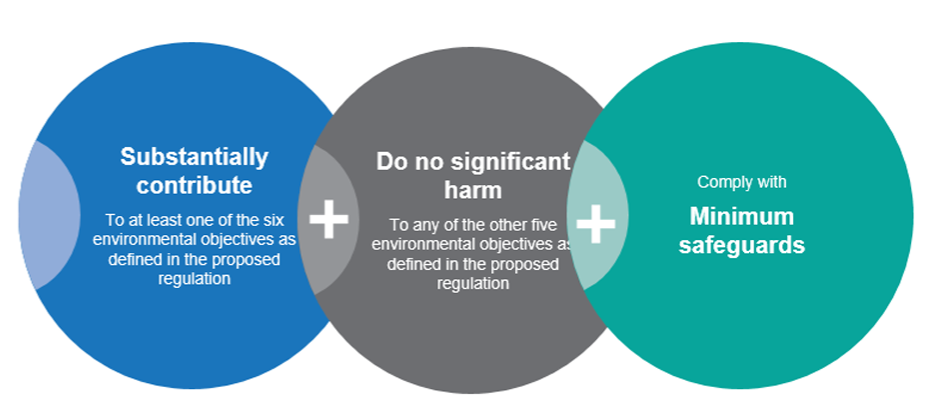

Specifically, for an activity to be Taxonomy-aligned, it must substantially contribute to at least one of the six EU environmental objectives—such as climate change mitigation, circular economy, or biodiversity—while ensuring it does no significant harm to any of the others. Additionally, it must comply with minimum social safeguards set by EU and international standards.

By creating uniform criteria for what “green” means, the Taxonomy acts as a common language for sustainable investments [3]. Although primarily a European regulatory framework, its influence extends well beyond the EU, as many global investors adopt these criteria for clarity and credibility.

How Investors Can Use the EU Taxonomy

A. Portfolio Assessment

For institutional investors—including asset managers, pension funds, and banks—the EU Taxonomy provides a structured way to measure and disclose the environmental performance of their holdings. Under Europe’s Sustainable Finance Disclosure Regulation (SFDR), any fund marketed as “sustainable” must specify its degree of alignment with the EU Taxonomy [3]. This requirement helps ensure that sustainability claims are grounded in evidence rather than marketing.

Mapping Each Holding

Portfolio assessment typically begins by mapping each holding against the Taxonomy’s technical screening criteria.

- Using Official KPI Disclosures: Many large, listed EU companies are required to disclose Taxonomy Key Performance Indicators (KPIs), such as aligned turnover, capital expenditure (CapEx), or operating expenditure (OpEx). Where these data are available, investors can incorporate them directly into their assessment.

- Conducting Manual or Third-Party Analysis: If a company has not disclosed official Taxonomy KPIs—common with smaller or non-EU firms—investors may rely on internal ESG research or third-party data providers. In these cases, they typically verify underlying assumptions to maintain consistency and credibility.

Calculating Taxonomy-Alignment Percentages

After mapping each holding, investors can calculate what share of their overall portfolio is Taxonomy-aligned. This percentage offers a transparent snapshot of environmental impact and can guide future allocation decisions.

Identifying and Addressing Gaps

Once alignment is assessed, investors can engage with companies that show partial or no alignment—encouraging them to adopt greener practices or meet the criteria. Alternatively, portfolio managers may rebalance capital toward more sustainable assets if certain companies fail to improve [4].

By following these steps, portfolio assessment becomes an evidence-based process that not only meets SFDR obligations but also demonstrates a genuine commitment to sustainability.

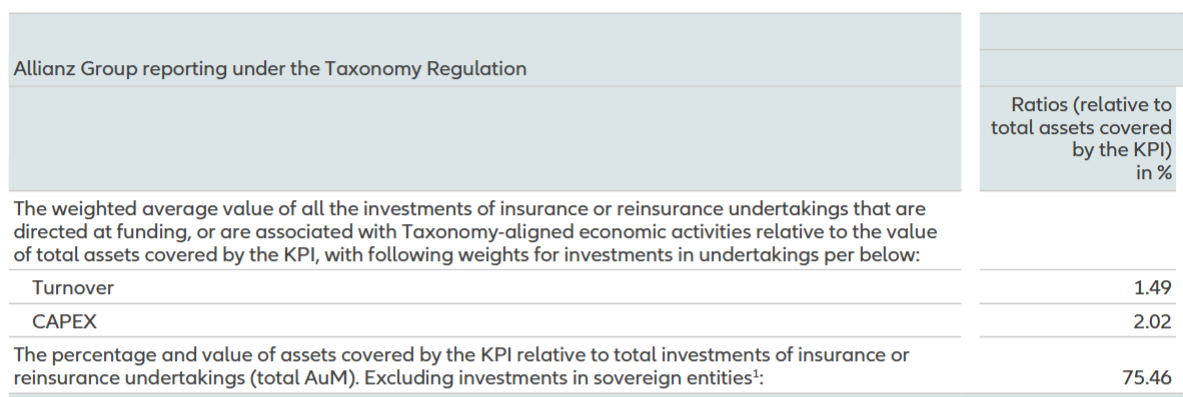

Illustrative Example: Allianz SE

Allianz SE, one of Europe’s largest financial services providers, reports in its 2023 Annual Report that 1.49% of its covered assets are Taxonomy-aligned based on turnover, 2.02% are aligned based on capital expenditure (CapEx), and these covered assets account for 75.46% of its total assets under management (AuM) within its insurance or reinsurance undertaking. By publishing these metrics, Allianz provides transparency on its Taxonomy-aligned investments and offers a practical example of portfolio assessment in action.

B. Product Development

The Taxonomy also shapes new financial products:

- Green or Thematic Funds: Asset managers can design products that invest primarily in Taxonomy-aligned activities, such as renewable energy or energy-efficient technologies. This approach helps address greenwashing by anchoring product criteria in a recognized standard [3].

- Taxonomy-Aligned Bonds: Issuers and investors of green bonds can reference the Taxonomy’s technical screening criteria to ensure that bond proceeds finance verified eco-friendly projects. The forthcoming EU Green Bond Standard will likely make such alignment even more transparent [3].

By embedding the Taxonomy in product creation, investors can meet the growing client demand for clear, credible green investments.

Illustrative Example: BNP Paribas Asset Management

BNP Paribas Asset Management has introduced several thematic funds designed to meet stringent sustainability standards, including references to EU Taxonomy criteria. One example is the BNP Paribas Energy Transition Fund, an Article 9 (SFDR) product that invests in companies promoting low-carbon solutions, such as renewable energy and energy efficiency. According to the fund’s documentation, Taxonomy-aligned screening is part of the due diligence process, aiming to ensure that a portion of the portfolio truly contributes to climate objectives.

By embedding EU Taxonomy screening into product design, BNP Paribas Asset Management demonstrates how financial institutions can develop transparent, credible green investments that align with evolving regulatory expectations and investor demand.

C. Due Diligence and Decision-Making

On a day-to-day basis, the EU Taxonomy functions as a due diligence checkpoint for investment professionals [4]:

- Screening Companies: Beyond calculating aggregate alignment, investors evaluate each company’s share of Taxonomy-aligned revenue or CapEx to decide if it meets their sustainability criteria.

- Assessing Risks: Firms that fail to disclose—or fail to meet—Taxonomy metrics can carry higher regulatory and reputational risks, influencing both portfolio construction and engagement efforts.

- Informing Retail Investors: Although most individuals may not delve deeply into the criteria, transparent labeling of a fund’s Taxonomy alignment can help them make more informed choices, reducing the risk of unknowingly investing in greenwashed products [7].

By incorporating these due diligence measures, investors can align capital allocation decisions with the EU’s sustainability goals, enhancing accountability and comparability across diverse strategies.

Hypothetical Use Case: Mr. Richard’s Investment Firm

Here’s how he applies its principles:

- Portfolio Assessment

Mr. Richard audits his holdings, checking which activities meet the Taxonomy’s technical criteria. He finds only 15% of his portfolio is fully Taxonomy-aligned. He targets 25% alignment in two years, prompting him to engage with certain portfolio companies on their sustainability plans. - Product Development

Sensing client demand for greener products, Mr. Richard designs a “Climate Leaders Fund” that focuses on companies meeting Taxonomy thresholds. The fund brochure lists a Taxonomy-alignment percentage, reassuring eco-conscious investors that there’s a rigorous underpinning to the fund’s sustainability claims. - Due Diligence

Before investing in new companies, Mr. Richard’s team checks each firm’s environmental disclosures. If a manufacturer lacks alignment now but has a robust plan to shift to green technologies, they may still invest—factoring in transition potential. Conversely, a company that claims to be “green” without meeting the criteria is seen as a greenwashing risk and excluded.

This approach grows Mr. Richard’s green credentials, while clients gain confidence in the authenticity of his firm’s sustainable products.

Key Benefits and Considerations

A. Benefits

| Increased Transparency | By adopting common definitions of what “green” entails, the Taxonomy reduces confusion and helps investors compare funds or companies more directly [2]. |

| Combat Greenwashing | With science-based thresholds, firms and asset managers cannot casually self-label as “green” without meeting specific metrics. This fosters greater credibility in the market [6]. |

| Regulatory and Market Alignment | Taxonomy disclosure is mandatory for certain EU-based products under SFDR. Non-EU entities often choose to conform voluntarily to attract EU capital and avoid accusations of greenwashing [5]. |

B. Considerations / Challenges

| Complexity and Data Gaps | The Taxonomy’s technical criteria can be challenging to interpret, and many companies (especially smaller or non-EU) don’t systematically report alignment data. Investors may need to rely on estimates or proxies [8]. |

| Evolving Coverage | So far, the Taxonomy mainly covers environmental objectives. A proposed Social Taxonomy and expanded environmental categories are in development, but until these are finalized, investors may need additional frameworks to capture the full spectrum of ESG factors [4]. |

| Transition vs. Strict Alignment | High-impact industries may not be Taxonomy-aligned yet but are critical to decarbonization. Many investors balance strict alignment with engagement strategies—pushing companies to improve rather than excluding them altogether [4]. |

Next Steps: Harnessing the EU Taxonomy for Greener Portfolios

The EU Taxonomy is a powerful catalyst for investors aiming to build more sustainable portfolios. As demonstrated throughout this article—whether by examining holdings for alignment, designing products under Taxonomy criteria, or conducting thorough due diligence—the framework provides a common, science-based standard that fosters transparency and trust.

Still, challenges remain. Data may be incomplete or inconsistent, certain sectors are yet to be fully covered, and many companies need time (and capital) to transition. But as the Taxonomy evolves and data quality improves, its role in steering capital toward truly sustainable activities will only expand. Aligning with these standards can add tangible value for both investors and the global environment.

Looking for comprehensive EU Taxonomy metrics?

Explore Tracenable’s EU Taxonomy Data, covering detailed alignment and eligibility information of around 2,000 companies worldwide. Get the insights you need to verify sustainability claims and strengthen your portfolio’s green profile.

References

[1] European Commission, “Communication from the Commission — Action Plan: Financing Sustainable Growth (COM/2018/97 final),” 2018. [Online]. Available: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52018DC0097.

[2] European Commission, “Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 (Taxonomy Regulation),” 2020. [Online]. Available: https://eur-lex.europa.eu/eli/reg/2020/852/oj.

[3] BNP Paribas, “The EU Taxonomy: what is the impact for investors and corporates?,” 2021. [Online]. Available: https://cib.bnpparibas/the-eu-taxonomy-what-is-the-impact-for-investors-and-corporates/.

[4] I. Hodžić and A. Isaksson, EU Taxonomy from the Perspective of Investors (Master’s Thesis), 2023. [Online]. Available: https://www.diva-portal.org/smash/get/diva2:1776059/FULLTEXT01.pdf.

[5] Harvard Law School Forum, “The Ripple Effect of EU Taxonomy for Sustainable Investments in U.S. Financial Sector,” 2020. [Online]. Available: https://corpgov.law.harvard.edu/2020/06/10/the-ripple-effect-of-eu-taxonomy-for-sustainable-investments-in-u-s-financial-sector/.

[6] Triodos Investment Management, “EU Taxonomy: key to climate neutrality or carte blanche to greenwashing?,” 2024. [Online]. Available: https://www.triodos-im.com/articles/2024/eu-taxonomy-key-or-carte-blanche.

[7] P. Engler, “How do individuals perceive the EU Taxonomy?,” 2024. [Online]. Available: https://sustainablefinancealliance.org/wp-content/uploads/2024/02/Engler-How-do-individuals-perceive-the-EU-taxonomy.pdf.

[8] Nixon Peabody LLP, “EU Taxonomy Simplification: Impact on Disclosures and Sustainable Investment Strategies,” 2025. [Online]. Available: https://www.nixonpeabody.com/insights/articles/2025/02/12/eu-taxonomy-simplification-impact-on-disclosures-and-sustainable-investment-strategies.

Disclaimer: The information in this post is for educational purposes and does not constitute financial advice. Always do your own research or consult a professional before making investment decisions.