EU Taxonomy 2026: What Changes for Non-Financial Undertakings

Since companies began publishing their first EU Taxonomy reports in 2023, a consistent pattern has emerged: while investors recognize the framework's value for comparing environmental performance, the reporting burden on companies has raised questions about data quality and reliability. The extensive disclosure requirements have stretched corporate resources thin, potentially compromising the usefulness of the data that reaches investment committees.

The European Commission has responded with amendment 2026/73 to the Disclosures Delegated Act, effective for the 2026 reporting cycle. The objective is explicit: reduce the "undue reporting burden" on companies without diluting environmental standards. This matters for investors because streamlined reporting should translate into more accurate, more consistent data. Companies can now focus on getting the essential metrics right rather than spreading resources across an unwieldy checklist.

The amendment cuts mandatory disclosure points and simplifies templates. The environmental criteria themselves remain unchanged. What changes is the volume and granularity of what companies must track and publish.

For investors relying on EU Taxonomy data in their allocation decisions, the changes affecting non-financial undertakings are particularly relevant. Here is what the 2026 updates mean in practice.

From “Exhaustive” to “Material”: A Structural Shift

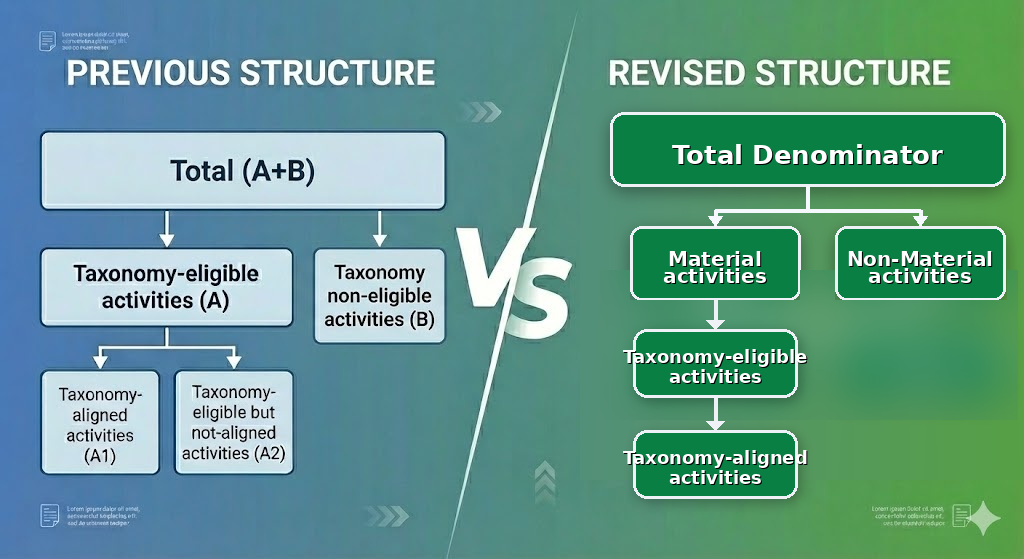

One of the most consequential changes in the 2026 update is the move away from the rigid Eligible (A) versus Non-Eligible (B) reporting binary that defined earlier cycles.

Under the previous framework, non-financial undertakings were required to assess all activities potentially falling within the scope of the Taxonomy. Total KPIs were divided into eligible and non-eligible activities, and eligible activities were further split into aligned and not aligned.

While methodologically coherent, this structure required detailed documentation even where activities were financially marginal or environmentally insignificant.

From 2026 onward, the focus shifts to materiality. Rather than mapping the entire business against the full potential scope of the Taxonomy, the revised approach prioritizes activities that are financially and environmentally significant.

This introduces a preliminary distinction between material and non-material activities before eligibility and alignment are assessed.

The familiar A+B, A, A1, A2 and B categorization is no longer the starting point of the reporting logic. The change does not, in itself, modify the underlying eligibility or alignment criteria. Instead, it introduces a materiality filter that determines which activities enter the eligibility and alignment assessment.

Non-financial undertakings may omit assessing certain economic activities for taxonomy eligibility and alignment where those activities are not financially material, specifically, where their cumulative Turnover, CAPEX, or OPEX represents less than 10% of the respective KPI denominator.

The omission applies to assessment, not disclosure. The related amounts must still be reported separately as non-material (not assessed), expressed as a proportion (%) of the relevant KPI denominator, presented in aggregated form, and accompanied by identification of the relevant NACE sectors in the narrative disclosure.

In effect, the rule reduces assessment burden while maintaining transparency. Its practical impact will depend on how materiality determinations and activity aggregation are applied in practice.

Moving to the Metrics: How this changes the reporting tables?

To understand how the 2026 updates change the "look and feel" of a report, let’s look at how a leader in sustainable building materials, like Rockwool A/S, navigates these disclosures.

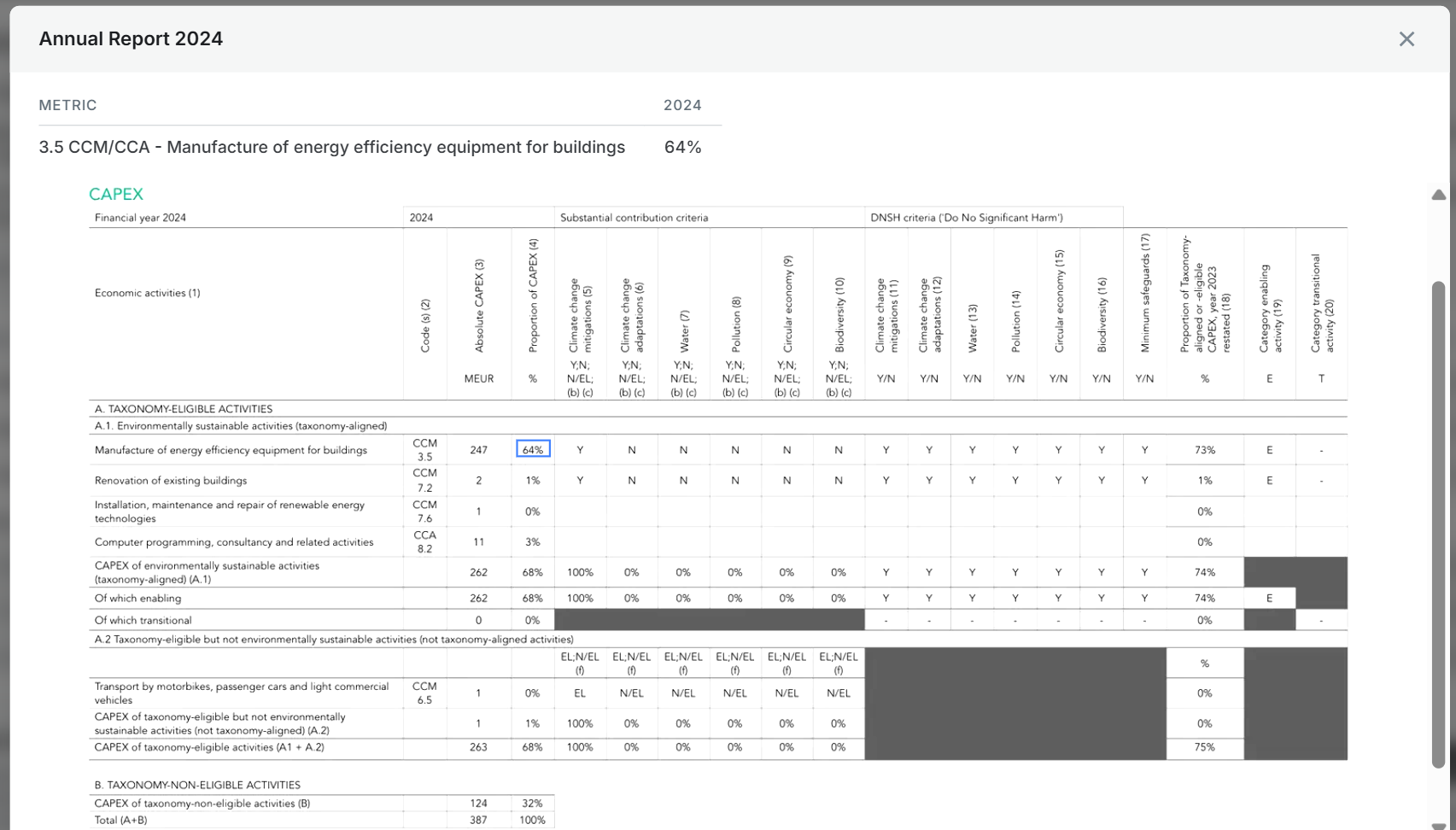

The “Before”: The Older 2023 Template

Rockwool’s CAPEX disclosure in its 2024 Annual Report follows the earlier template, organized around the established eligibility hierarchy.

The table is structured around the following metrics:

- A1 – taxonomy-aligned (activity and total levels)

- A2 – taxonomy-eligible but not aligned (activity and total levels)

- A – total taxonomy-eligible (A1 + A2; total)

- B – taxonomy non-eligible

- A+B – total KPI

The organizing principle is eligibility-first. Every portion of the denominator is explicitly categorized as eligible or non-eligible, and eligible activities are further divided into aligned and not aligned.

Two additional features characterizes this template:

- Qualitative Substantial Contribution indicators

Activity rows includes qualitative markers (e.g., Y, N, EL, N/EL) indicating contribution to environmental objectives.

Where activities contribute to multiple objectives, double counting at total level is avoided through calculation rules. In practice, the most relevant objective is indicated in bold at activity level (for example, a bold “EL” or bold “Y” under the most relevant objective), and only that objective is considered when computing the quantitative contribution for A1, A2 or A totals, even if multiple objectives are indicated. - DNSH and MSS disclosure columns

Multiple columns capture compliance with Do No Significant Harm (DNSH) criteria for each environmental objective. DNSH requires that an activity contributing substantially to one objective does not cause significant harm to the others, based on detailed technical screening criteria.

In addition, it also includes a separate column (Column (17) in the screenshot) confirming compliance with Minimum Safeguards (MSS), referring to alignment with OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights.

The result is comprehensive and granular, but also highly segmented and data-intensive.

The “After”: Reporting Under the 2026 Template

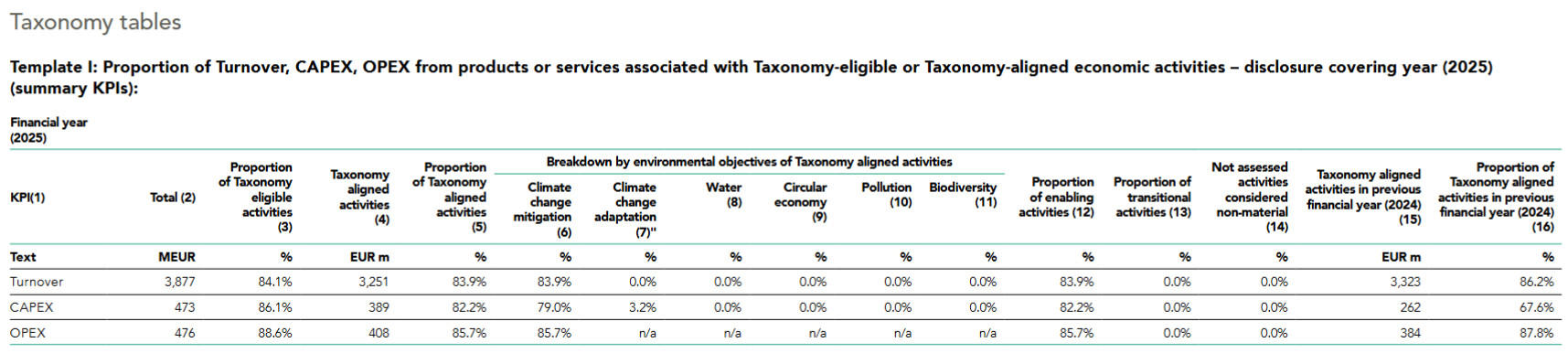

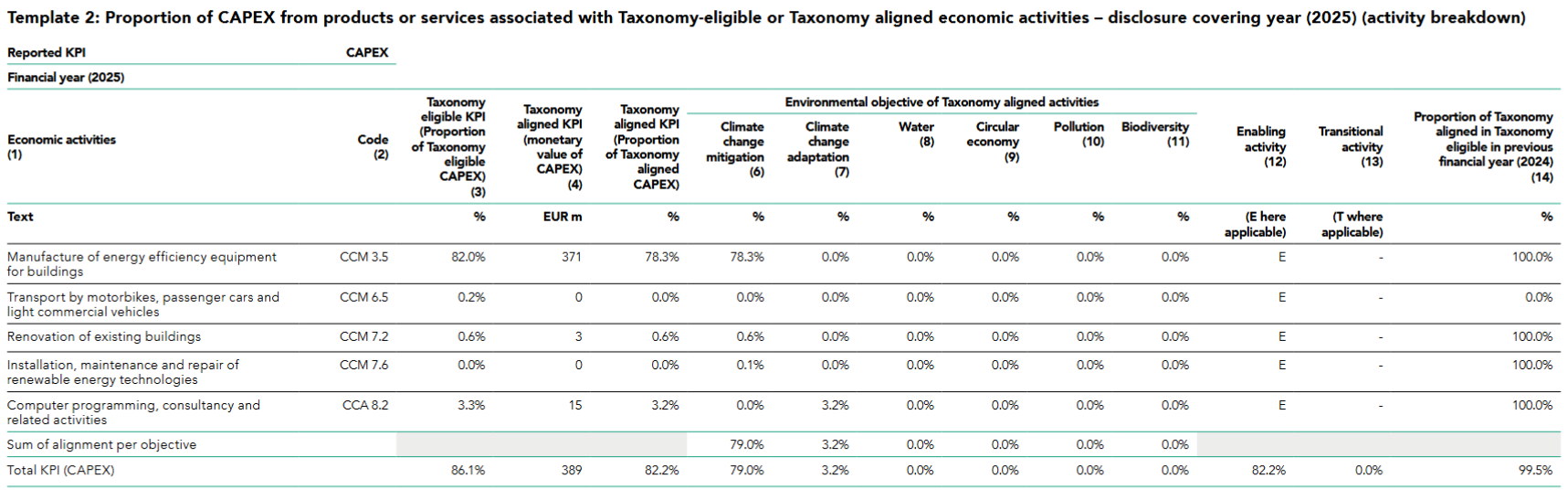

Rockwool’s Taxonomy disclosure in its 2025 Annual Report reflects the revised Annex II format of the Regulation.

Under the 2026 framework, two templates apply:

- Template 1 – Summary KPIs, presenting total Turnover, CAPEX and OPEX.

- Template 2 – Activity Breakdown, providing activity-level metrics for each KPI. In practice, this means one activity table per KPI.

Within this new architecture, several changes become evident.

Consequence

From Eligibility Split to Materiality Split

In Template 1 (Summary KPIs), Column (2) is labelled 'Total' and contains the value of the respective KPI’s denominator. This figure functions as the reference base against which all proportions in subsequent columns are calculated.

Rather than beginning with eligibility classification, the table first makes explicit the share of the KPI that is not assessed. Column (14) of Template 1 captures the proportion of the Total considered non-material and therefore not assessed for taxonomy eligibility or alignment.

The remainder of the Total represents the material portion, and this portion must be assessed in full. For economic activities deemed material, undertakings are required to determine taxonomy eligibility and alignment for the entire amount attributable to those activities; no part of a material activity may be treated as non-material.

Eligibility metrics are then reported in relation to the Total in both templates:

- Column (3) – proportion of the Total that is Taxonomy-eligible

- Column (5) – proportion of the Total that is Taxonomy-aligned

In this structure, the non-material portion is identified explicitly, and eligibility and alignment are disclosed for the fully assessed, material share.

Because the table now separates material from non-material before assessing eligibility, the earlier A/B segmentation is no longer displayed.

The “eligible but not aligned” portion (A2) remains mathematically derivable, but it is not shown separately. Likewise, non-eligible activities are not presented as a standalone B category. They are absorbed within the assessed material portion or remain unassessed within the non-material portion.

Substantial Contribution and Double Counting

Under the earlier template, substantial contribution to the six Environmental Objectives (EO) was reflected through a mix of qualitative and quantitative values. In addition, the meaning of those values depended on whether the row referred to A, A1 or A2. For example:

- If the row referred to aligned (A1) activities, a figure of 10% under Climate Change Mitigation (CCM) meant that 10% of the KPI was taxonomy-aligned to that objective.

- If the row referred to eligible but not aligned (A2) activities, the same 10% under CCM meant that 10% of the KPI was eligible for that objective but did not meet alignment criteria.

- If the row referred to total eligible (A) activities, the percentage represented the overall eligible share linked to that objective, including both aligned and not aligned portions.

In other words, the column headings remained the same, but the interpretation shifted depending on which metric was being displayed.

In the 2026 template, substantial contribution is expressed exclusively in quantitative percentage terms. The contribution columns represent the share of the ‘total’ denominator (Column 2 of template 1) associated with Taxonomy-aligned activities contributing substantially to each environmental objective.

Furthermore, the treatment of double counting is more explicitly structured:

- At the activity level (Template 2), contributions to multiple objectives may be disclosed simultaneously. No stylistic prioritization is used, and overlaps across multiple objectives are permitted.

- At the total eligible and total aligned level (Template 1 and the “Total KPI” row of Template 2), double counting is not permitted. Only the most relevant objective for each aligned activity may be considered in aggregation, such that the sum of contribution percentages equals the total aligned proportion reported in Column (5).

No Dedicated DNSH or MSS Columns

DNSH compliance remains a condition for taxonomy alignment, but it is no longer displayed through dedicated columns in the reporting tables. The same applies to confirmation of compliance with Minimum Safeguards (MSS).

Under the 2026 templates, DNSH and MSS are embedded in the alignment outcome itself rather than shown as separate checklist-style disclosures. The tables focus on the quantitative share of aligned activities, while the procedural elements underpinning alignment are not presented in standalone columns.

New Activity-Level A1/A Ratio

Template 2 introduces a formal activity-level ratio of aligned within eligible (Column 14). This makes explicit, for each activity, the proportion of Taxonomy-aligned share relative to its total Taxonomy-eligible proportion.

🌟2026 Template: What’s New and What’s Gone?

|

What’s New

|

|

What’s No Longer Explicit

|

The underlying KPIs remain unchanged. What has evolved is the segmentation logic and presentation structure.

Denominator Integrity and the Question of “B”

While the revised template simplifies presentation, it also raises a structural question: how should the ‘total’ denominator now be interpreted?

Recital (6) of the amendment makes two points clear:

- Non-material activities should not be removed from the denominator.

- Undertakings must report non-material activities separately, at aggregated level.

This suggests that the ‘total’ denominator (Column(2) of Template 1) continues to encompass all activities, including those deemed non-material. One possible reading is therefore:

Total denominator = material portion + non-material portion

On that basis, it appears that what was previously reported as non-eligible (that is, "B”) may now be implicitly distributed between:

- The assessed material portion (implicit non-eligible outcomes), and

- The non-material portion (unassessed activities).

The 2026 amendment should preserve denominator integrity, but it no longer provides a discrete visibility layer for non-eligible activities as a category of its own.

Recital (6) indicates that it “should be avoided” that non-material activities are removed from the denominator and that undertakings include deliberately harmful activities within the non-material portion.

The formulation is notable. Rather than framing denominator integrity as a direct obligation in operative terms, the recital uses precautionary language. This leaves some interpretative space around how strictly the denominator must be constructed in practice.

From a data integrity and comparability perspective, greater prescriptive clarity could have reduced uncertainty for both preparers and users of the data.

A Structural Recalibration

Taken together, these changes reflect a recalibration in the structure of Taxonomy disclosures for non-financial undertakings.

The reporting logic moves from an eligibility-first segmentation to a materiality-first assessment. Certain categories become implicit. Aggregation rules are formalized. The tables are simplified, but the underlying judgments on materiality, eligibility and aggregation are less visible and therefore require closer scrutiny.

For undertakings preparing their next reporting cycles, the revised Annex II templates will begin to apply to financial years starting on or after 1 January 2026. For financial years beginning during 2025, continued use of the older 2023 format remains possible. In practice, this creates a transitional window in which both structures may coexist in the market.

The KPIs themselves remain grounded in the same regulatory framework. What has evolved is the disclosure architecture and the sequencing of assessment.

Whether the revised structure ultimately enhances clarity, comparability and investor usability will depend less on the templates and more on how consistently materiality determinations, aggregation choices and governance controls are applied in practice.

At Tracenable, we have been capturing EU Taxonomy data reported by non-financial undertakings since the first reporting cycles in 2021 and have already begun integrating disclosures prepared under the revised 2026 templates. As the reporting architecture evolves, maintaining continuity and comparability across cycles becomes as important as understanding the changes themselves.